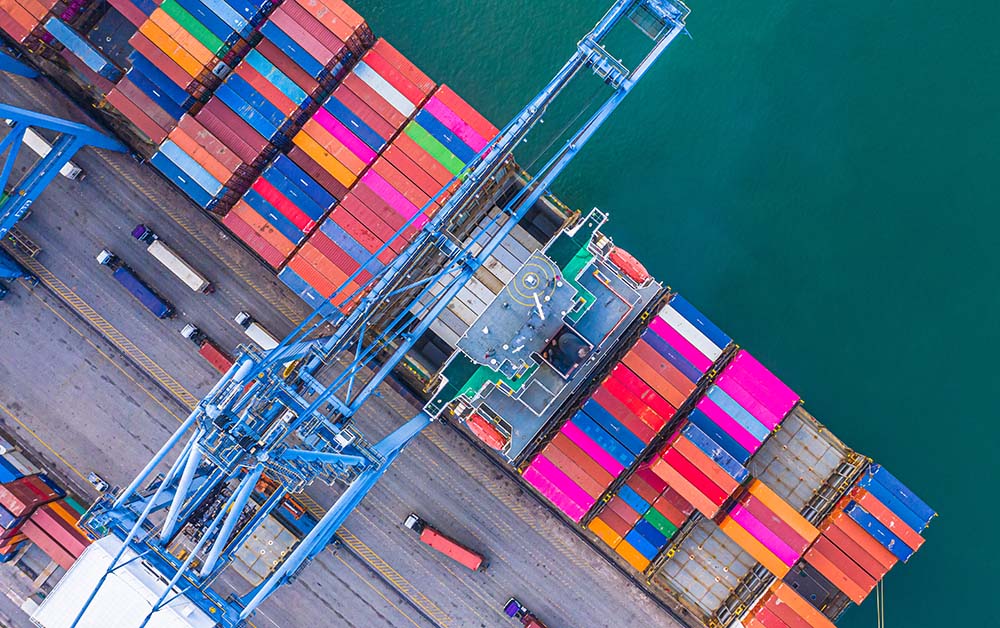

The global supply chain crisis over the past two years has challenged the world’s most sophisticated supply chain processes. As executives now move from a crisis management mindset to one that can afford to take the time to consider long-term strategic moves, the drive to reshore manufacturing operations and supply sourcing is growing.

Trends

A Thomas survey conducted last year showed that 65% of all global sourcing managers are reconsidering their sourcing strategies and 69% of those are likely, highly, or extremely likely to shift some of their sourcing to US domestic markets.

As recently as December of 2021, statistics show that this transition could be well underway. Construction spending in the manufacturing sector was the fastest growing industry among all those measured by the US Census Bureau. Manufacturing construction was 30.5% higher than just a year ago with $86 billion in annual spending. It was the fifth largest construction sector in the US behind power generation, highways and streets, education, and commercial construction.

The biggest hurdle to cost-effective reshoring has been and is the cost of domestic labor, certainly exacerbated by the labor shortages employers are currently experiencing. This hurdle is being addressed by implementing smart manufacturing. By using advanced automation, Big Data analytics and robotics, smart manufacturing allows domestic producers to compete against lower-priced labor markets found in other countries.

According to Thomas, the process of reshoring could drive more than $443 billion into the US economy over the next 5 years, creating a significant amount of growth over the long-term.

Mergers and Acquisitions

Investors have started to look optimistically at the US manufacturing sector and the positive prospects that reshoring can provide. There are several areas where merger and acquisition activities are playing a role fueling this optimism.

First, pooling resources to better utilize existing facilities in the US will increase in popularity. Companies that have been successfully operating in the US at a competitive cost or higher quality make attractive targets for those that have complimentary products they want to reshore. Expanding an existing facility or leveraging US domestic experiences lend significant advantages. Pooling resources also allows companies to bring more resources to quickly convert facilities into smart manufacturing operations, which is a primary acquisition strategy in this environment.

Second, by increasing productivity and efficiency by implementing smart manufacturing and thereby reducing global supply chain risk, companies are boosting operating margins and increasing competitiveness. This potential upside in profitability makes them attractive acquisition targets.

Lastly, not only is the mergers and acquisition sector looking for opportunities within the manufacturing sector itself, but the real estate leasing sector is also expanding quickly to support the needs of manufacturers. Industrial real estate is becoming extremely valuable and is competing with warehousing for space. US warehousing construction used for ecommerce distribution grew 18% in 2021 and is expected to grow by 22% in 2022. Projections are that ecommerce distribution will occupy 27% of all new industrial real estate space between now and 2026. There are many opportunities for companies to use acquisition strategies to secure strategic real estate.

If you are considering a move to expand domestic manufacturing activity or to create a foundation that others could utilize to expand their activities domestically, MarksNelson has the resources to help. We can assist in multiple areas, from mergers and acquisitions to site selection to financial strategies and analytics and automation and a variety of other services catering to manufacturing and distribution. Reach out to us today to learn more about our holistic approach.